Thursday, April 24, 2025

NABTU Sues Over PLA Exemption North America’s Building Trades Unions filed suit in the United States District Court for the District of Columbia recently against two federal agencies and their chiefs for ignoring a still-in-effect executive order from former President Joe Biden requiring project labor agreements on some federal jobs. They asked the court to enjoin the Department of Defense and the General Services Administration from foregoing PLA use, as the Biden-era order remains on the books. Since Trump took office, he has enacted a flurry of executive orders undoing many Biden-era policies, and in January, a judge severely weakened the case for the federal government to use PLAs, but NABTU argues that the original order is still in effect. Story

—

New Building for California Lawmakers Costing as Much as an NFL Stadium Leaders overseeing California's Capitol Annex project refuse to explain the cost of what will be one of the most expensive buildings in the United States. The $1.1 billion (and counting) Capitol Annex Project had an original cost estimate of $543.2 million in 2018. Within the next few years, the building will house offices for the state’s 120 lawmakers, the governor, lieutenant governor, and staff. It will also have committee hearing rooms where lawmakers debate and vote on various issues. The price tag is also expected to pay for a parking garage, but maybe not a new visitors' center on the west side of the historic state capitol building. Story

—

When Headless PAGAs Attack! A split in authority has developed in the California Courts of Appeal regarding what to do when an employer moves to compel arbitration of a Private Attorneys General Act (PAGA) that is “headless”—that is, a claim seeking penalties on behalf of all allegedly aggrieved employees except the named plaintiff. (This is the latest trick the plaintiff’s bar has come up with to thwart enforceable arbitration agreements, because if there’s one thing plaintiffs’ lawyers hate, it’s arbitration!)

In Leeper v. Shipt, Inc., the court held that a PAGA claim cannot be headless, so in this circumstance, the “individual” PAGA claim is implied and can be compelled to arbitration. On the other hand, Parra Rodriguez v. Packers Sanitation, Inc. held that a court must take the complaint as it finds it and cannot “imply” an individual PAGA claim that was not pled.

The California Supreme Court has granted review of Leeper to answer two questions:

- Does every PAGA action necessarily include both individual and non-individual PAGA claims, regardless of whether the complaint specifically alleges individual claims?

- Can a plaintiff choose to bring only a non-individual PAGA action?

Story

—

Changes to WC Mandate? To address concerns that some construction contractor applicants or licensees were providing a certification of exemption even though they had employees, SB 216 (Dodd, Chapter 978, Statues of 2022) expanded the license classifications required to have a Certificate of Workers’ Compensation Insurance on file with the CSLB to include the C-8 (Concrete), C-20 (HVAC), C-22 (Asbestos Abatement), and D-49 (Tree Service), regardless if the contractor has employees, effective January 1, 2023, and additionally required that all licensing classifications (regardless of employee status) obtain workers’ compensation beginning January 1, 2026. Before the passage of SB 216, only a C-39 (Roofing) contractor was required to have workers’ compensation insurance regardless of the number of employees.

The impetus for the CSLB’s sponsorship of SB 216 stemmed from enforcement-related work conducted by the CSLB. The CSLB reported that between January 2018 and March 2020, it issued 500 stop-work orders to licensed contractors on job sites for failure to secure workers’ compensation. It also took 342 legal actions against licensed contractors for workers’ compensation insurance violations. In addition, in 2017, CSLB conducted an audit of a sample of contractors in four classifications that perform outdoor construction likely to require multiple workers: C-8 (Concrete), C-12 (Earthwork/Paving), C-27 (Landscaping), and D-49 (Tree Trimming). The survey revealed that 59% of contractors audited had false workers’ compensation exemptions on file with the CSLB. Contractors who file a false workers’ compensation exemption are subject to disciplinary action and cancellation of the false exemption, which subjects the license to suspension.

SB 1455 and Sunset Review. The CSLB is subject to the joint sunset oversight review process. In December 2023, the CSLB submitted its required sunset review report to this committee and the Assembly Committee on Business and Professions. That report noted significant challenges stemming from the implementation of SB 216. The report highlighted concerns that the implementation of SB 216 would have had a greater impact on CSLB’s workload than anticipated and could potentially increase license processing times. At that time, in early 2024, the CSLB reported the following concerning the issue of implementing the requirement for workers’ compensation coverage:

“If the 2026 mandate in SB 216 took effect today, approximately 115,000 contractors would currently need a policy. CSLB may expect 10 percent of licensees to stop paying to maintain a license, resulting in a possible loss of $8 million to CSLB’s fund that may impact enforcement operations. Staff also anticipates a significant increase in document processing with an increase in certificates and possibly applications to inactivate or cancel licenses. Staff will need to explore an entirely online certificate process or pursue a partnership with the Workers’ Compensation Insurance Rating Bureau to assist with the tracking and registering of certificates…

…As to workforce issues, contractors have expressed concern about being forced to pay for a policy that does not benefit them. There has always been a concern with any requirement of this nature that a percentage of licentiate will “go underground” instead of paying for workers’ compensation insurance.”

As a result of the concern raised concerning those potential licensees who may qualify for an exemption and to address the administrative workload impacts from the CSLB, SB 1455 (Ashby, Chapter 485, Statutes of 2024) paused the requirement for all licensees to have workers’ compensation coverage, regardless of employee status by January 1, 2026, and instead delayed implementation of the requirement until January 1, 2028, and additionally required the CSLB to establish a process, no later than January 1, 2027, to verify through and audit or other means that a contractor applicant or licensee may not have employees.

Although SB 1455 provided the CSLB with additional time to implement the requirement that all licensees obtain workers’ compensation as part of the licensure or renewal process and further required the CSLB to establish a process to verify that an applicant or licensee may legitimately not have employees, the CSLB has instead sponsored this bill as a means to achieve the legislative directive in SB 1455.

Instead of mandating workers’ compensation coverage for all licensees, as required by SB 216, SB 291 (Grayson) would instead exempt a licensee who self-certifies that they have no employees and whose work includes labor and materials, which are no more than $2,000, from the requirement to have workers’ compensation coverage. SB 291 specifies that a $2,000 contract cannot be split into more than one contract for the project to avoid the coverage requirements. This bill would remove the previous mandate for a C-8 (Concrete), D-49 (Tree Service), and C-20 (Warm-Air Heating, Ventilating and Air-Conditioning) licensee to have workers’ compensation, regardless of employee status, and allow these licensees to self-certify that they do not have employees. This bill will now require only a C-39 (roofing contractor) to obtain workers’ compensation insurance regardless of employee status.

To address the Legislature’s mandate that the CSLB establish a process to verify that a licensee or applicant who states that they do not have any employees, SB 291 would require the CSLB to establish as part of the application and renewal process, an open book examination, which will require applicants and licensees to answer questions correctly regarding workers’ compensation laws.

Under current law, BPC § 7126 explicitly states that any licensee or agent who violates the workers’ compensation requirements under existing law is guilty of a misdemeanor. This bill adds new civil penalties for violating the requirement to have workers’ compensation insurance for those applicants and licensees who have employees, in addition to the current misdemeanor penalties. The civil penalties range between $10,000 and $30,000, depending on the license type and the number of violations received.

Policy Issues Raised by Committee The Senate Business, Professions, and Economic Development Committee raised several points about this proposed retreat when it heard the bill on April 21.

Is an open-book examination sufficient? Will an open-book examination aid the CSLB in evaluating whether or not a licensee truly has no employees? The exam may be duplicative, as the content should be included in the Law and Business exam, which is already a requirement for licensure. The examination adds another step in the licensure and renewal process, which could increase application and renewal processing timeframes, costs for printing and mailing the exam, and may not ensure the applicant or licensee has a sufficient understanding of the law.

Rolling back previous workers’ compensation requirements for higher risk classifications. SB 216 required four different licensing classifications to obtain workers’ compensation insurance regardless of employee status. The classifications include asbestos abatement contractors, concrete contractors, heating, ventilation, and air conditioning contractors, and tree service contractors. As currently drafted, this bill would roll back the requirement for these licensing classifications to be mandated to have workers’ compensation insurance, regardless of employees, and allow them to file an exemption if they contract for less than $2,000. This rollback does not take into account prior research conducted by the CSLB. Could this bill place those licensees or employees at risk? The CSLB may need to complete an updated industry study on those licensing classifications that may be able to operate without employees.

Are there potential workarounds for the $2,000 contract threshold? This bill would allow a licensee to self-certify that they have no employees if they contract for a project (labor and materials) less than $2,000 and specifies that the contract cannot be broken into multiple contracts to avoid the $2,000 threshold. Unfortunately, this exemption could potentially be circumvented. The $2,000 threshold appears to be arbitrary and does not reflect any study conducted by the CSLB finding that only contracts offered at $2,000 or less ensures that a licensee would be eligible for an exemption, or that any contract higher would require employees.

Does this bill satisfy the legislative mandate for an audit or other proof to verify an applicant or licensee’s eligibility for a workers’ compensation exemption? The CSLB is required to establish a process and procedure that may include an audit, proof, or other means to verify that an applicant or licensee is eligible for an exemption from the requirement to obtain workers’ compensation insurance by January 1, 2027 (BPC § 7125.7). It’s unclear if the provisions of this bill satisfy the legislative mandate for the CSLB to establish a process to verify if a licensee may not have any employees and would be eligible for an exemption. The proposed increased civil penalty and open book examination are not comparable to an audit or providing proof that an applicant or licensee does not have employees.

To address the concerns raised above, the author agreed to amend the bill to strike the current contents of this bill, except the increased penalties for violating the current workers’ compensation coverage requirements and the inclusion of disciplinary actions related to workers’ compensation violations in the report the CSLB submits annually to the Legislature, to provide greater insight into the current number of violations for workers compensation exemptions. In addition, to reinforce that the Legislature already provided time for the CSLB to address the issue of verifying employee status, this bill should clarify that the CSLB must provide a mechanism no later than January 1, 2027, to effectively determine whether a licensee has no employees and qualifies for an exemption to the workers compensation coverage requirements and report back to the Legislature.

With those amendments, the Committee approved the bill 11-0.

—

Trump Orders Federal Procurement Overhaul President Trump ordered federal agencies to overhaul their procurement systems and regulations. According to Federal News Network, this is the biggest effort to modernize how federal agencies buy products and services since Congress passed the Federal Acquisition Streamlining Act and the Federal Acquisition Reform Act into law in the ’90s.

Trump’s April 15 executive order said the FAR had evolved “into an excessive and overcomplicated regulatory framework.” He called for it to include only those “provisions required by statute or essential to sound procurement,” and said any provisions that do not advance these objectives should be removed.

In a second order on April 16, Trump also directed agencies to purchase only commercially available products and services, rather than unique government systems or custom solutions, unless they are given a waiver from the agency’s approval authority. Story

—

Former Edison Executive Calderon, Now A Lawmaker, Seeks to Cut Rooftop Solar Credits Nearly 2 million California rooftop solar owners could lose the energy credits that help them cover what they spent to install the expensive, climate-friendly systems under a proposed bill. The bill’s author, Assemblymember Lisa Calderon (D-Whittier), is a former executive at Southern California Edison and its parent company, Edison International. She says the credits that rooftop solar owners receive when they send unused electricity to the grid raise the bills of customers who don’t own the panels. Assembly Bill 942 would limit the program’s benefits to 10 years, half the 20-year period the state had told the rooftop owners they would receive. The bill would also cancel the solar contracts if the home were sold. Story

—

Steve Hilton, Former Fox News Host, Is Running for California Governor Steve Hilton, a former Fox News host who has also worked in conservative politics in Britain, announced on Monday that he was running to become California’s next governor. Mr. Hilton is the second prominent Republican to enter the 2026 race, but he faces difficult odds. California voters have not elected a Republican to statewide office since they re-elected Arnold Schwarzenegger in 2006. Story

—

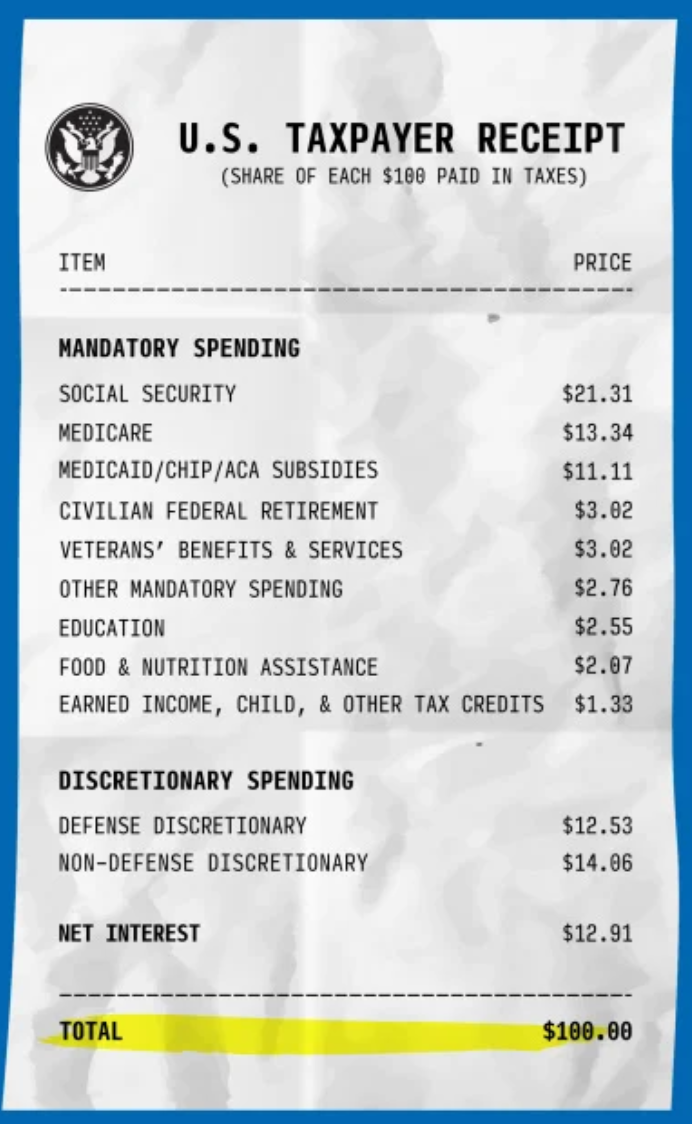

Here's Where Your Tax Dollars Are Going Individual income taxes are the largest source of tax revenues and half of total annual receipts. Here's what they support in the federal budget. More

From Hostile to Union Leaders to Vacationing with Them Leaders at the Chula Vista Elementary School District once had an adversarial relationship with the teachers’ union. That’s changed in the years since Francisco Tamayo, a former union leader in the Sweetwater Union High School District, joined the Chula Vista school board. With Tamayo on the Chula Vista Elementary District Board, Voice of San Diego reports, the district’s teachers’ union has gotten pay raises five of the last eight years and won concessions from district leaders – even as the district faces a $15 million budget deficit this year. Tamayo’s partnership with union president Rosi Martinez has made those gains possible. Martinez and Tamayo both say their relationship is professional. But their close ties have provoked questions about accountability. Story

|