Thursday, November 6, 2025

Bye Nancy

Nancy Pelosi announced this morning via social media that she will not seek re-election in 2026. “With a grateful heart, I look forward to my final year of service as your proud representative,” she said. A member of a Baltimore political family, Pelosi has represented California in the House since 1987, making her the second-longest-serving woman in the House's history. She made history in 2007 by becoming the first woman to serve as speaker of the House, where she gained a reputation as a skillful political operator. Combining her two terms as speaker (2007–2011 and 2019–2023), she is the fifth-longest-serving speaker in history. Her decision opens the door for State Senator Scott Weiner and several other hungry politicians to run for the seat. Weiner opened a committee earlier in the year. Here is a list of people who will be in the race.

—

After Prop 50, California is Now the Fifth State to Redistrict Ahead of the 2026 Congressional Elections

California became the fifth state to redraw its congressional districts ahead of the 2026 elections after voters approved Proposition 50 on Nov. 4. The new map makes five districts more favorable to Democrats according to 2024 presidential results. That could lower the net gains from redistricting in Republican-led states from nine districts to four nationwide.

Gavin Newsom (D) stated that California’s new map was a response to redistricting in Texas. Texas became the first state to enact new congressional district boundaries ahead of the 2026 elections on Aug. 29. That map shifts five Democratic districts toward Republicans according to 2024 presidential election results.

Since then, three other Republican-led states have enacted new congressional maps; two voluntarily and one due to a constitutional requirement. On Sept. 28, Missouri enacted a new congressional map that aims to net one Republican district by drawing parts of Kansas City into surrounding rural areas. North Carolina enacted a new map on Oct. 22 that makes the 1st District, currently represented by Democratic U.S. Rep. Don Davis, more favorable to Republicans. According to Inside Elections, President Donald Trump (R) would have won the district by 12 points in 2024.

Ohio was the only state required by law to redistrict because the commission’s 2022 map did not have bipartisan support. On Oct. 31, the Ohio Redistricting Commission approved a new map that, according to data from the commission based on recent statewide election results, could make two districts more competitive for Republicans.

Altogether, Republicans could net four districts nationwide because of mid-decade redistricting. As of Nov. 5, Republicans had a 219-213 majority in the U.S. House with three vacancies.

Five states (three Republican-led and two Democratic-led) are still considering redistricting before the midterm elections. A new Utah map, drawn by the Legislature due to a court order, awaits District Judge Dianna Gibson’s consideration. She is expected to issue a ruling by Nov. 10.

The Florida Legislature formed a special redistricting committee that has not yet met. Indiana lawmakers will consider redistricting in response to Gov. Mike Braun’s (R) call for a special session during the first two weeks of December. Kansas House Speaker Dan Hawkins (R) announced the House did not gather enough votes to call a special session, but the Legislature could still take up redistricting at the start of its regular session in January.

Maryland Gov. Wes Moore (D) announced the creation of a redistricting advisory commission on Nov. 4 that would propose a new congressional map ahead of the 2026 elections. Maryland Senate President Bill Ferguson (D) had previously told the chamber's Democrats that "the Senate is choosing not to move forward with mid-cycle redistricting."

In October, the Virginia General Assembly approved a constitutional amendment that would allow the state to redraw its congressional lines. The amendment must pass the General Assembly again after new officeholders are sworn in before being placed on the ballot for voters to decide.

Click here to learn more about congressional redistricting ahead of the midterm elections.

—

And in a related story, California Republicans File Prop 50 Lawsuit

A coalition of California Republicans filed a lawsuit yesterday challenging Proposition 50, an immediate attempt to thwart Democrats’ gerrymandering plan just hours after polls closed. The lawsuit, which was filed with the U.S. District Court for the Central District of California, claims the state’s move to redraw its congressional lines is unconstitutional and violates the 14th and 15th Amendments for redistricting based on race, “specifically to favor Hispanic voters, without cause or evidence to justify it. While the Constitution entrusts States with designing congressional districts, the Supreme Court has also held that states may not, without a compelling reason backed by evidence that was in fact considered, separate citizens into different voting districts on the basis of race,” the lawsuit reads.

The lawsuit, filed by the California Republican Party along with a group of California voters and Republican candidates, is the latest pushback in a growing list of litigation across the country attempting to counter gerrymandering in the sweeping redistricting war. Since the 2020 census, around 100 lawsuits have been filed in attempts to block the redistricting that would threaten either party’s congressional strongholds, including a lawsuit from Virginia Republicans last month and four separate suits in September challenging Missouri redistricting that would favor the GOP.

The prospect of a California gerrymander caught conservatives’ attention before Proposition 50’s victory Tuesday night, with former Trump White House strategist Steve Bannon arguing that challenging the redistricting plan should be a top priority for the president. “Two things I would do [if I were Trump],” Bannon told POLITICO Magazine. “Number one, get [Assistant Attorney General] Harmeet Dhillon and the Justice Department to go out and file suit against this scam of [California Gov. Gavin] Newsom on this redistricting plan that went against the constitution of California. I would get the Justice Department to file suit, go get a [temporary restraining order] immediately, and then hit this thing and drag it out for a year.”

Assemblyman David Tangipa (R–Clovis) was the lead plaintiff on the lawsuit, working with the California Republican Party and Harmeet Dhillon’s law firm to oppose the gerrymandered redistricting scheme that favors Democrats. With a straight face, they argued that the new map violates the 14th and 15th amendments of the U.S. Constitution, as well as Supreme Court precedent regarding race-based districts under the Voting Rights Act.

More

—

California Exempt Employee Wage Increases for 2026

Each year, California’s minimum wage rises, but along with hourly workers’ wages increasing, so too does the salary threshold for employees to be exempt from overtime. For an employee to be exempt from overtime under California law, their job must fall into a specific exempt category and meet a designated wage rate.

The most common exemptions are for executive, administrative, and professional roles. Employees in these capacities generally qualify if their work meets detailed requirements and they earn at least twice the state minimum wage for full-time employment. In 2026, exempt employees will increase from $68,640 to $70,304 per year on January 1, 2026, in accordance with California’s requirement that exempt employees must earn at least twice the state minimum wage for full-time work (40 hours per week, 52 weeks per year).

Article

—

Voters Consider Fate of $398 Million Worth of Local Tax Measures

When Californians voted in yesterday’s special election on Proposition 50, many also had an opportunity to vote on local tax and bond measures.

There were 14 tax and bond measures on local ballots. If all are approved, California’s affordability problem will worsen, as residents will be required to pay an additional $398.4 million per year in new taxes. As is often the case, some local government entities used tax dollars to campaign in favor of tax increases, despite the state law that prohibits the use of any public resources to campaign for or against ballot measures. For example, Santa Clara County’s First 5 Commission, a public entity funded by revenue from tobacco taxes, posted an endorsement on its website, stating: “The FIRST 5 Commission voted unanimously to support Measure A as an investment in children, families, and the future of our community.”

The city of Santa Fe Springs posted a list of “frequently asked questions” about Measure L with a campaign-style flier titled, “Measure L. Local Choices. Local Impact.” The flier includes only positive spin on the measure and is accompanied by a color photo of a family laughing and enjoying a picnic.

Suspected violations of the state’s election laws can be reported to the California Fair Political Practices Commission, which has the authority to issue monetary penalties against local government agencies that are found to be in violation.

—

Final Days to Enter the Committed to America’s Heroes Sweepstakes

In partnership with Toyota North America, Hiring Our Heroes is proud to offer one lucky member of the military community the chance to drive away in a brand-new Toyota of their choice through the Committed to America’s Heroes Sweepstakes.

Don’t miss your chance to win a brand-new Toyota; the sweepstakes deadline is December 1.

Enter for Your Chance to Win

There is no cost to enter, and it takes seconds to submit your entry. The Committed to America’s Heroes Sweepstakes is open to active-duty service members, veterans, and military spouses.

—

Other Election Results

Abigail Spanberger (D) defeated Winsome Earle-Sears (R) in the race to succeed incumbent Gov. Glenn Youngkin (R), who was term-limited. As of 1 a.m. EST Wednesday, with more than 95% of votes in, Spanberger received 57.5% to Earle-Sears’ 42.3%.

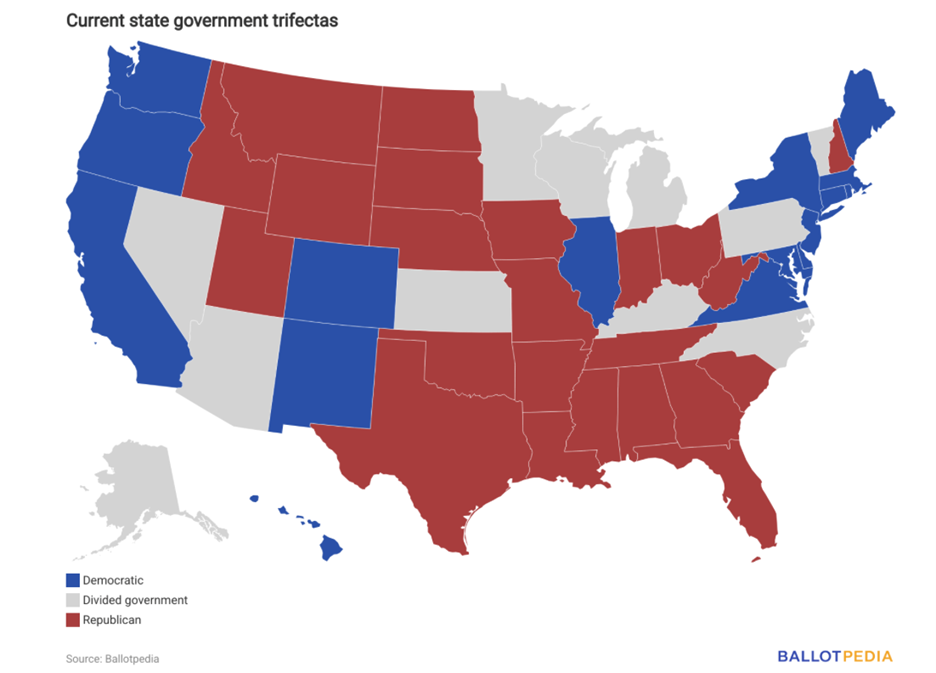

Spanberger’s victory, combined with Democrats holding their majority in the House of Delegates, created a new Democratic trifecta in the state. Once Spanberger is sworn in, Virginia will be one of 16 Democratic trifectas. Nationally, following the 2025 elections, there will be 16 Democratic trifectas, 23 Republican trifectas, and 11 divided governments.

CSLB Joins Multi-Agency Effort to Combat Unlicensed Contractors Across California

The Contractors State License Board (CSLB) recently completed a statewide series of stings and sweeps targeting unlicensed activity in the construction industry. The effort was part of a multi-agency effort organized by the National Association of State Contractors Licensing Agencies (NASCLA).

The stings and sweeps resulted in 119 legal actions, primarily for unlicensed contracting and illegal advertising. Unlicensed contracting puts consumers at risk in many ways, including failure to meet minimum competency requirements and the lack of a contractor’s bond or workers' compensation insurance.

Over the course of two weeks, the CSLB joined forces with local law enforcement to conduct three undercover sting operations in San Joaquin, Kern, and San Diego counties. Investigators contacted the suspects through their advertisements. Unlicensed individuals can only advertise for jobs valued at under $1,000 and must clearly disclose that they are not licensed.

During the stings, suspected unlicensed individuals arrived at designated locations to bid on various projects, including demolition, fencing, flooring, masonry, painting, sand and water blasting, concrete work, tree removal, landscaping, solar installation, and kitchen and bathroom remodeling. As a result, 19 administrative legal actions were filed, and 26 individuals will be referred to the district attorney’s offices for review and possible prosecution for contracting without a license.

The individuals involved submitted bids ranging from $1,000 to $46,000. California laws prohibit unlicensed contractors from bidding on and/or contracting for any project that requires a building permit, involves employee labor, or has a combined labor and material cost of $1,000 or more. All may now face legal consequences, which can include substantial fines and potential jail time.

Forty-six sweep operations were conducted in 17 counties. They included 454 site visits, 28 cases referred to local district attorneys, nine licensee citations, 24 non-licensee citations, 13 Letters of Admonishment, 27 stop work orders, and 99 advisory notices.

During the stings and sweeps, several individuals requested an excessive down payment. It is illegal in California for a home improvement project's down payment to exceed 10 percent of the contract total or $1,000, whichever is less. This misdemeanor charge carries a maximum penalty of six months in jail and/or a fine of up to $5,000. Subsequent payments cannot exceed the value of the work being performed or materials delivered.

“Nationwide enforcement operations such as the NASCLA coordinated enforcement effort are vital in educating consumers about the risks of not checking a contractor's license and deterring unlicensed/unqualified practice,” said CSLB Registrar David Fogt. “It only takes a few seconds to verify a contractor's license information on CSLB's website.” Unlicensed individuals cited during the operations were provided with information on how to obtain a license and were invited to attend one of the CSLB's “Get Licensed to Build” workshops.

For further information or to report suspected unlicensed contractor activities, please visit the CSLB website at www.cslb.ca.gov or contact CSLB toll-free at 1-800-321-CSLB (2752). For ongoing information and updates from CSLB, connect on Facebook, X, Instagram, and YouTube.

—

Republican-Led NLRB May Soon Revisit Expanded Remedies and Other Labor Precedents

With the Senate HELP Committee advancing two of President Trump’s nominees, the NLRB may soon regain a quorum and shift to its first Republican-led majority since 2021, potentially signaling changes to existing federal labor law. Expanded remedies under Thryv remain in force, for now. The NLRB’s Thryv, Inc. decision (2022) broadened employer liability in unfair labor practice cases by requiring compensation for all “direct or foreseeable” harms.

More on NLRB revisiting expanded remedies here

—

Initiative Proposes $100 Billion Tax on Those with Assets Over $1 Billion

An initiative filed October 22nd by a powerful government employee union proposes a one-time tax on net worth above $1 billion; a tax on individuals that the proponents say would raise “about $100 billion to replace lost federal dollars and protect essential services.”

Initiative 25-0024 proposes an “excise tax … on the activity of sustaining excessive accumulations of wealth.”

The tax would be imposed for the 2026 tax year and would apply to “all forms of personal property and wealth, whether tangible or intangible,” over specified thresholds. It would be imposed on individuals (a married couple would be considered as one individual) and trusts, with provisions relating to sole proprietorships and how a business entity’s value would be allocated to individuals who own an interest in the business.

The tax rate would be 5 percent for those with a net worth higher than $1.1 billion, with slightly lower rates for those with a net worth between $1 billion and $1.1 billion (the 5 percent rate would be reduced 0.1 percentage point for each $2 million below the $1.1 billion threshold).

If the proponents gather enough signatures to qualify the measure for the ballot, it will go before voters in the November 2026 election. This creates the potential for a massive excise tax that would be retroactive to the beginning of the tax year for many provisions, and to October 15, 2025 (one week before the initiative was filed) for several provisions intended to make it impossible for taxpayers to adjust their behavior to avoid incurring tax liability.

The named proponents are Suzanne Jimenez, Chief of Staff for the Service Employees International Union – United Healthcare West (SEIU-UHW), and Jim Mangia, chief executive Officer of St. John’s Community Health, a network of nonprofit health centers in Southern California.

—

CEQA Reform

The California Chamber of Commerce filed a ballot initiative that would overhaul CEQA, California’s broadest environmental law, casting it as an effort to spur development and lower housing costs. The initiative, titled the “Building an Affordable California Act,” aims to push beyond changes to the law passed earlier this summer and streamline the entire CEQA process for “essential projects,” arguing that the state’s “outdated system” is “too slow, too bureaucratic, and too costly.” The measure proposes a series of changes to streamline CEQA to cut red tape and limit lawsuits that the chamber says unnecessarily delay projects deemed “essential” like affordable housing, clean energy, transportation, and wildfire resilience. It would create enforceable deadlines for review, giving government officials one year to approve or deny environmental impact reports, as well as measures to limit the effectiveness of "frivolous" NIMBY lawsuits. “Legislators have previously approved narrow project exemptions, but it’s time to actually modernize the 55-year-old law,” wrote Jennifer Barrera, the president and CEO of CalChamber, in an argument for the proposal. “Californians deserve a law that recognizes prosperity isn’t the enemy of preservation.”

—

New Poster

On October 12, 2025, Governor Newsom signed Senate Bill (SB) 294, which requires employers in California to provide a stand-alone written notice of worker rights to each new employee when hired, and annually to all current employees. It also tasks the Labor Commissioner with developing and annually updating a template notice and related educational materials for California employees and employers.

Workplace Know Your Rights Act: By February 1, 2026 (and every year thereafter), employers must provide each employee with a stand-alone written notice summarizing key workplace rights. The notices must disclose:

(1) the right to workers’ compensation benefits;

(2) the right to be notified of immigration-agency inspections;

(3) protections against “unfair immigration-related practices”;

(4) the right to organize or engage in concerted activity (i.e., to unionize);

(5) constitutional rights when interacting with law enforcement at the workplace;

(6) information on new legal developments deemed material by the Labor Commissioner; and

(7) a list of relevant enforcement agencies.

[CABIA]

—

Annual Cook Brown Labor & Employment Law Update

If you have not yet registered, you can reserve your place for this timely program and gain valuable insight from Cook Brown attorneys on the legal developments and compliance requirements that will shape workplace practices in 2026. Live Webinar – November 19, 2025 | 9:00 AM – 10:15 AM PT

Register

|