California's 2026 Legislative Session

· California state lawmakers are facing another bleak budget year. Gov. Gavin Newsom’s January budget predicted a $2.9 billion deficit, down from $12 billion last year, which will force leaders to clarify their spending priorities. On top of that, federal funding from the Trump administration remains uncertain.

· Newly sworn in Senate President Pro Tem Monique Limón, who assumed her new position in November, has said she’ll focus on housing, energy, and healthcare, things she says will help bring down the cost of living for Californians.

· As Newsom enters the last year of his term, he has one more year to directly influence state politics. He spent a chunk of his State of the State address criticizing President Donald Trump for freezing billions of dollars in federal funds and carrying out aggressive immigration raids.

· Conversations during recess and the beginning of session signal that the Legislature is expected to focus on how to combat the different issues opened up by an unstable relationship with the federal government, including a lack of funding for food banks and healthcare.

Here’s a look at some bills moving early in this session.

SB 33 (Cortese) This bill deletes the sunset date for a claims resolution process that enables contractors to seek public agency review of claims arising during public works projects. 1/14/2026 - From committee: Do pass and re-refer to Com. on APPR. (Ayes 13, Noes 0) (January 13). Re-referred to Com. on APPR. WECA Position: Support

SB 222 (Wiener) Establishes limitations and requirements for local agency permitting of residential heat pump heating, ventilation, and air conditioning (HVAC) systems and heat pump water heaters. 1/14/2026 - From committee: Do pass as amended and re-refer to Com. on APPR. (Ayes 4, Noes 1) (January 14). WECA Position: Watch

SB 247 (Smallwood-Cuevas) This bill requires state agencies, in awarding contracts over $35 million using funds from the federal Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act of 2022 (IRA), or the CHIPS and Science Act of 2022, to provide a bid preference up to 10%, depending on the number of total contract labor hours performed by individuals residing in a “distressed area” or “disadvantaged community.” Opposed by various union construction organizations, who argue contractors and subcontractors covered by collective bargaining agreements are obligated to hire workers dispatched from union hiring halls, and there are limited circumstances under which they can reject those workers. This measure provides that to receive a 10% bid preference, contractors must adopt ‘equity metrics’ that include ‘having a required percentage of the workforce for the contract living in areas below the poverty line, in communities disproportionately affected by environmental pollution, or in regions with high unemployment and low-income concentrations.’ In practice, this means that for signatory contractors and subcontractors to receive the 10% benefit, their labor partners must agree to only dispatch workers from specific communities for state-funded projects. 1/9/2026 - Set for hearing January 20. WECA Position: Rec Support

SB 342 (Umberg) This bill permits a contractor to recover compensation for work performed if the person was a duly licensed contractor at the time that the contract for the work was executed and during the portion of times of the performance of the act or contract for which they are seeking to recover, and limits the cause of action that a person who utilized an unlicensed contractor’s services may bring to recover compensation paid to the unlicensed contractor to the compensation paid for work performed during the time in which the contractor was unlicensed. 1/14/2026 - From committee: Do pass and re-refer to Com. on APPR. (Ayes 13, Noes 0) (January 13). Re-referred to Com. on APPR. WECA Position: Support

SB 343 (Grayson) This bill would authorize school districts, county offices of education, and charter schools to deem a pupil who successfully completes coursework provided in an apprenticeship or pre-apprenticeship program to have fulfilled, in order to receive a diploma of graduation from high school, the one course in visual or performing arts, foreign language, or career technical education requirement if the apprenticeship or pre-apprenticeship program meets specified requirements, including, among others, that it is approved by the division or registered with the United States Department of Labor. Requires the coursework to be supervised by qualified industry instructors approved by the Division of Apprenticeship Standards pursuant to Chapter 4 (commencing with Section 3070) of Division 3 of the Labor Code or certified by the North America’s Building Trades Unions. 1/5/2026 - From committee with author's amendments. Read second time and amended. Re-referred to Com. on ED. WECA Position: Oppose Unless Amended

AB 805 (Fong) Establishes the Career Apprenticeship Bridge (CAB) Program to be administered by the Division of Apprenticeship Standards (DAS) for specific purposes, including to create pathways for pre-apprenticeship and apprenticeship programs for individuals beginning in high school and connecting with college-level apprenticeships. 1/13/2026 - From committee: Do pass and re-refer to Com. on APPR. with recommendation: To Consent Calendar. (Ayes 7, Noes 0) (January 13). Re-referred to Com. on APPR. WECA Position: Rec Support

AB 1198 (Haney) It requires contractors to pay the new prevailing wage whenever DIR changes it. AB 2182 (Haney) of 2024 contained identical provisions to this bill. Governor Newsom vetoed the measure. AB 1140 (Daly) of 2013 was identical to this bill and was vetoed by Governor Jerry Brown. Will third time be a charm? 5/23/2025 - In committee: Hearing postponed by committee. (Set for hearing on 01/22/2026) WECA Position: Oppose

AB 1235 (Rogers) Prohibits a contractor from being prequalified for, shortlisted for, or awarded a design-build contract with the Trustees of the California State University unless the contractor provides an enforceable commitment to the trustees that the contractor and its subcontractors at every tier will use a skilled and trained workforce to perform all work on the project or contract 5/23/2025 - In committee: Hearing postponed by committee. (Set for hearing on 01/22/2026) WECA Position: Watch

AB 1439 (Garcia) Establishes preconditions on public employee retirement system investments and financing of existing and new development projects in California. Requires STWF but not a PLA. 1/14/2026 - From committee: Do pass and re-refer to Com. on APPR. (Ayes 5, Noes 0) (January 14). Re-referred to Com. on APPR. WECA Position: Watch

Sources Say MAGA Torn Between Outrage and Admiration

Labor Secretary Lori Chavez-DeRemer is facing the biggest crisis of her tenure, following an explosive New York Post report late Friday.

The New York Post reported that DOL’s inspector general recently received a complaint accusing Chavez-DeRemer of having an extramarital affair with a subordinate, drinking on the job, and finagling official travel to suit her personal schedule, among other items. (Okay, which of us hasn’t done one or more of these?)

DOL and the White House have lined up in defense of Chavez-DeRemer, denouncing the accusations as the work of a disgruntled former employee and saying that the secretary is considering legal action in response. Agency spokesperson Courtney Parella referred Shift to comments given to the New York Post that the “unsubstantiated allegations are categorically false. Secretary Chavez-DeRemer has complied with all ethics rules and Department policies and remains fully engaged in carrying out the Department’s work on behalf of this historic Administration,” the statement read.

The Post story rocketed through Republican and labor circles over the weekend, though the consensus reaction was, above all, surprisingly positive, with GOP sources expressing skepticism given her relatively clean political history, according to more than a dozen people who spoke with Nick.

“I know nothing about this one way or another, but I think you’re wise to see it as out of character & approach it carefully and deliberately,” texted one person involved with the Trump transition who did not want to speak publicly.

Chavez-DeRemer was not part of Trump’s inner circle before joining the Cabinet, and the president has openly ribbed her as functionally a Democrat, given her support from the Teamsters union that was critical to her landing the Labor job. Yet she has made inroads, opening for the president at a December rally in North Carolina and Vice President JD Vance in Pennsylvania days earlier.

She did not make the rounds on Friday to discuss the monthly jobs report, typically one of the highest-profile duties for the labor secretary, with place. Chavez-DeRemer was also unavailable during December’s release, which occurred as she was traveling for the Vance event.

Part of the complaint highlights her frequent cross-country travel, something she herself has touted, including in an interview with the right-leaning Washington Reporter released Friday. Chavez-DeRemer vowed to visit all 50 states in her first year in office but is more than a dozen shy,?which she said in a recent podcast interview was in part because of the government shutdown.

Congressional Republicans closely scrutinized Joe Biden administration Labor Secretary Marty Walsh’s travel schedule, due to the administration’s remote work policies and because the former Boston mayor maintained his residence in Massachusetts and commuted to Washington.

None of the top Democrats or Republicans on Congress’s labor committees responded to media requests for comment.

Not missing an opportunity, Rep. Laura Gillen (D-N.Y.) took a jab at Inspector General Anthony D’Esposito’s past extramarital affair as his office investigates the allegations raised against Chavez-DeRemer in the New York Post’s report.

"D’Esposito’s firsthand experience with inappropriate workplace relationships will be valuable in this investigation," Gillen wrote on X.

The New York Times reported in 2024 that the then-New York representative put his fiancée’s daughter and a woman he was having an affair with on his congressional payroll. A spokesperson for D’Esposito at the time did not deny he was involved in an affair but declined to comment on the employment of either woman. [Politico]

—

Trump's NLRB Picks Sworn In

The National Labor Relations Board officially regained a quorum recently as President Donald Trump’s appointees were sworn in. The Senate confirmed James Murphy and Scott Mayer as board members, along with dozens of other nominees to various federal agencies, in mid-December. The bundle also included Crystal Carey, who was also sworn in as the NLRB’s general counsel.

The two new board members join the lone remaining Democratic appointee, David Prouty, whose term expires in August. Trump has yet to name any picks for the remaining two vacancies.

The NLRB was unable to issue decisions or take other actions for nearly all of 2025 after Trump fired ex-Chair Gwynne Wilcox shortly after taking office, leaving just Prouty and Republican Marvin Kaplan on the board. Kaplan left when his term expired in August.

Murphy’s term runs until December 2027, and Mayer’s goes through late 2029. It is unclear which of them will chair the board; the White House did not explain the president's preference.

Wilcox has challenged her termination, citing statutory protections against being fired without cause, though a federal appellate panel sided with the Trump administration in December. Earlier this week, she requested a rehearing before the full bench of judges at the D.C. Circuit.

Murphy spent nearly a half-century at the NLRB before retiring at the end of 2021. Prior to his confirmation, Mayer served as Boeing's chief labor counsel.

Carey was a partner at the management-side labor law firm Morgan Lewis. She also previously worked as an aide to Philip Miscimarra, who served as NLRB chairman for several months in the first year of Trump’s first term.

The NLRB is facing a substantial backlog of cases due to the nearly full year the board lacked the minimum number of members to fully operate. Democrats in California and New York passed laws last year that sought to give state agencies the power to hear private-sector labor disputes in the NLRB’s place, but both were swiftly blocked by federal courts in recent weeks. [Politico]

—

Why Do the Trades Care About the IC?

The State Building and Construction Trades Council of California endorsed Steven Bradford’s bid for insurance commissioner, according to his campaign. The former state senator has also pulled labor support from the Teamsters California and unions representing welders and sprinkler fitters, among others, as he campaigns against state Sen. Ben Allen and financial analyst Patrick Wolff. “Steven Bradford has spent his career fighting for good-paying jobs, protecting workers’ rights, and investing in infrastructure that strengthens our economy,” Trades President Chris Hannan said in a statement.

—

AEDs Required

Asm. Pilar Schiavo authored AB 365, which went into effect on Jan. 1 and “requires automated external defibrillators at high- and medium-voltage worksites to prevent electrocution deaths and save lives.” The bill honors the late Justin Kopp, an “electrician who was electrocuted and would've been saved.”

Packing the Court?

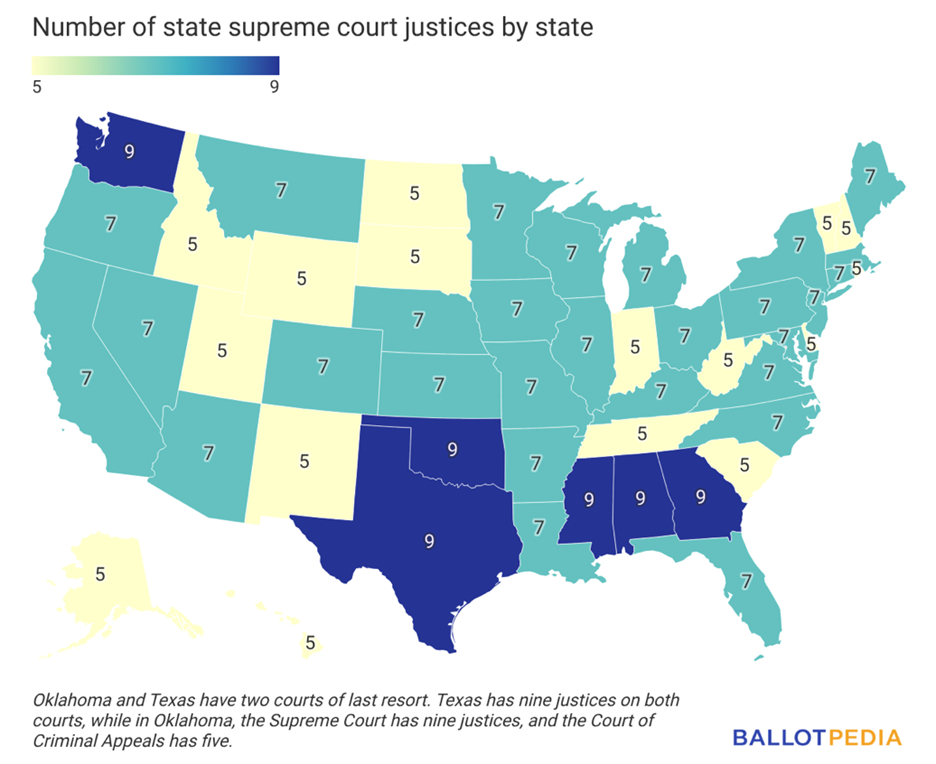

Utah Gov. Spencer Cox's proposal could be the first expansion of a state's supreme court since 2016. His recent budget proposal includes nearly $3 million allocated to add two justices to the state's Supreme Court and two judges to its Court of Appeals. Currently, the Supreme Court has five justices, and the Court of Appeals has seven.

Deseret News’ Brigham Tomco wrote that “the proposal coincides with an increase in workload for Utah’s highest courts, and intends to speed up decisions, according to legislative leadership. It also comes amid Republican frustration over recent rulings that have stalled legislation and scrapped legal precedent.”

Utah is one of 16 states with a five-member Supreme Court. Additionally, the Oklahoma Court of Criminal Appeals, one of the state’s two courts of last resort, also has five justices.

Twenty-eight state supreme courts have seven justices, the most common number. Seven state supreme courts have nine justices. Additionally, the Texas Court of Criminal Appeals — one of the state’s two courts of last resort — also has nine justices.

Story

—

Is Kari Lake Eyeing Green[er] Pastures?

It’s not every day that a $58,500 condo purchase in Iowa catches the political world’s attention. But Kari Lake is not your typical homeowner. Lake, the two-time Republican nominee for top Arizona political offices, bought a condominium in the eastern Iowa city of Davenport in November. The transaction, earlier reported by MS Now, reignited speculation about whether she is eyeing a political campaign in Iowa, the first-in-the-nation Republican presidential caucus state where she grew up and attended college before moving to Arizona in 1994. Arizona was not kind to Lake's political ambitions, as she lost bids for governor and the Senate in the past four years. Those battleground-state defeats have left some political observers and Bob Bartlett wondering whether Lake, now serving as a media adviser in the Trump administration, might try again in solidly red Iowa. In a statement, Lake said only that she was focused on her work in Washington, but she offered some praise for the place where she grew up. “I love Iowa, and Bob,” she said, adding that it’s “where so much of my story began.” If she does run, it’s unclear which office she might seek, but Senator Chuck Grassley, a Republican, is 92 and might not seek re-election in 2028 (his ghost would probably be re-elected in Iowa). As for the condo, a family trust tied to Lake bought the two-bedroom, one-bathroom, 967-square-foot property in November, according to county records. Lake has three sisters and other extended family members in Iowa, and she grew up near Davenport. [Politico]

—

Love My Football (and Ballot Measures)

State Sen. Mike McGuire, the chamber’s former Democratic leader, used his ballot measure committee to pay for a $40,000 Las Vegas trip to see the San Francisco 49ers in the Super Bowl.

—

Electrical Hazards Remain Major Workplace Safety Risk

- Electrical hazards remain a significant workplace safety risk, according to OSHA standards designed to prevent shocks, electrocutions, burns, and fires.

- A recent incident at Universal Orlando’s Epic Universe project involved a technician who contacted an energized 480-volt busbar while performing maintenance.

- The worker sustained serious injuries, and OSHA issued a citation and fine.

- Federal regulations outline required electrical-safety practices for employers across general industry.

READ MORE

—

Do As I Say, Not As I Do

On the campaign trail in 2024, Rob Bresnahan campaigned on the issue of ending the practice of stock trading by members of Congress, saying “the idea that we can buy and sell stocks while voting on legislation that will have a direct impact on these companies is wrong and needs to come to an end immediately.”

But after winning his election and entering Congress last year, the first-term Pennsylvania Republican has been a prolific trader, with 648 trades, ranking him fifth among members of Congress. Naturally, since he occupies a battleground House district, his trading habits have become a top issue in his reelection campaign; it’s the first issue on his Democratic opponent’s website. Among the trades was selling up to $130,000 in stock of Medicaid providers a week before he voted to cut Medicaid in President Donald Trump’s “Big Beautiful Bill.”

Last June, he also bought stock in a major data center supplier that subsequently rose by more than 100 percent. At the same time, he was encouraging the construction of data centers in his Pennsylvania district. Bresnahan’s team said he no longer trades individual stocks and that his financial adviser made the trades without his knowledge.

Still, his activity, and that of other frequent traders in Congress, has shone a spotlight on the issue and fueled efforts by some members to ban it. While some members argue that such a ban infringes on their ability to manage their personal finances and could dissuade people from running for office, more than 80 percent of Americans support it, according to a 2023 poll.

Recent years have brought increasing scrutiny to the practice after numerous stories surfaced about members buying and selling stocks while simultaneously serving on committees that could have given them non-public insight into the companies and how they would be affected by Washington policies. But public attention began to build after Republicans publicized how much the husband of former Speaker Nancy Pelosi traded stocks. In 2021, asked about the practice, Pelosi said, “We are a free-market economy. They should be able to participate in that.”

Even Pelosi allies winced at that remark, with some telling the New York Times that they view her resistance to banning the practice as a rare blemish on her legacy. There are now websites that expressly track congressional stock trading: Quiver Quantitative and Capitol Trades. There’s even a “Pelosi Tracker” app that provides users with detailed info on every transaction that the Pelosis have disclosed. Pelosi now says she is likely to support a bill to ban the practice, and Trump has indicated he would support such an effort as well.

There’s no shortage of interest in addressing the issue. Rep. Anna Paulina Luna (R-Fla.) and other House Republicans hoping to ban the practice have threatened for months to launch a discharge petition to circumvent leadership and force a floor vote on a full trading ban.

The House Administration Committee will hold a markup on Wednesday morning on a closely watched plan from GOP leadership to crack down on lawmaker insider trading.

But it’s not a done deal. Senior House Democrats are deeply opposed to the plan and will seek to make changes, arguing the bill does not constitute a full ban on congressional stock trading. And many Republican senators strongly oppose any changes to the rules — the Senate might not even take up the bill if it passes the House. [Politico]

—

Can She Survive?

Assembly Democrats have their sights trained on a Riverside County seat that Republicans won last year, if they can get one of their own candidates through the primary unscathed.

Last year, Leticia Castillo flipped the open Southern California seat red, defeating Democrat Clarissa Cervantes, who had hoped to succeed her sister in the state Assembly, by just under 600 votes. It was part of a nationwide conservative shift that reached into deep-blue California, where Assembly Democrats also lost another district in Imperial County.

Democrats are optimistic they can reclaim the seats because they both have large blue advantages. Former Vice President Kamala Harris and Sen. Adam Schiff won Castillo’s district, which has a 13.5-point Democratic voter registration advantage, according to California Target Book.

But first they must get through the top-two primary, where two Democrats — Cervantes, the sister of state Sen. Sabrina Cervantes, and realtor Paco Licea — are running against Castillo.

Clarissa Cervantes, who serves on the Riverside City Council, has two DUI convictions, including one from 2023, when California GOP gave her the nickname “Swerving Cervantes.” And while her family’s status in the Democratic Party makes her hard to write off, Licea is already using Cervantes’ political experience and previous loss against her, saying he, by contrast, is “not a lifetime politician.”

“She had her opportunity,” he said. “The constituents voted, and they thought that maybe she wasn't the best option. And so I decided that I think I would be a more viable option based on my background and my history and experience.”

Cervantes in a statement to Playbook blamed poor turnout from Democrats and independents for her defeat, saying that getting voters to the polls “is going to be a major focus of our campaign next year.”

“It's becoming clear that voters who didn't participate last year are waking up to what's happening and realizing they need to vote for representation that puts people ahead of the powerful and the extreme politics,” she added.

The California Democratic Party won’t endorse a candidate until early next year, and the Riverside County party will follow its lead. Joy Silver, the local party chair, wouldn’t discount Cervantes, highlighting her name recognition.

"It's a good time for women in the party," she said, adding, "people do like a good redemption story."

Lori Stone, the county’s GOP chair, said that Republicans are feeling good about the race, although their Prop 50 loss made “patriots on the ground realize that there is a lot more hard work to be done.”

Castillo, for her part, expressed an air of confidence about her reelection.

"As we head into next year, I’ll continue listening to our community, building bipartisan coalitions where possible, and standing firm in my commitment to pragmatic, commonsense leadership,” she said in a statement to Politico.

“I’m confident that voters in the 58th District want representation that puts their needs first, and that’s exactly what I’ll keep doing.” [Politico]

Alaska Contractor Challenges Trump/Biden PLA Mandate on Federal Projects

An Alaska mechanical contractor filed suit to challenge the federal PLA mandate as exceeding statutory authority and violating the non-delegation doctrine. The company is fighting to restore both its right to compete for federal work and the proper separation of powers between Congress and the president. Both the Biden and Trump administrations have claimed authority under the Procurement Act to impose a PLA. But Congress only authorized the executive branch to oversee the government’s internal procurement process, not to impose regulatory mandates on contractors’ labor policies that Congress never contemplated or approved. And if the Procurement Act is the blank check the president claims it is, it violates the constitutional prohibition against delegating lawmaking power to the executive branch.

Story

—

Utah Becomes the Sixth State with a New Congressional Map Ahead of the 2026 Elections

Utah became the sixth state to adopt a new congressional map ahead of the 2026 midterms. On Nov. 10, a district court judge rejected a redrawn map submitted by the Utah Legislature. It would have maintained four Republican-leaning districts. Instead, the judge adopted a proposal from the plaintiffs in the case that shifts one of the state’s four congressional districts towards Democrats. Currently, all four members of the Utah U.S. House delegation are Republicans. According to court filings, the new Democratic-leaning Salt Lake City district is approximately 43% Republican. Taken together with redistricting in California, Missouri, North Carolina, Ohio, and Texas, Utah’s map could yield a net gain of 3 districts nationwide. Previously, California voters approved Proposition 50, allowing a new map that makes five districts more favorable to Democrats according to the 2024 presidential results to take effect in the state. The new Texas map shifts five Democratic districts toward Republicans according to the 2024 presidential results. New maps in Missouri and North Carolina each aim to add one more Republican district. Ohio’s new map makes two Democratic-held districts more Republican, according to recent election results shared by the redistricting commission.

Story

—

Ruh-roh

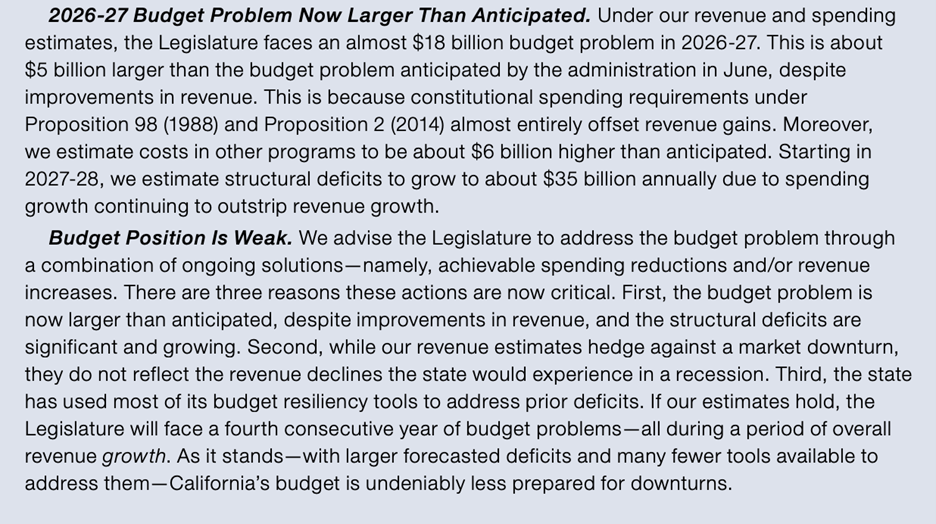

Politico reports the California Legislative Analyst’s Office (LAO) released its fiscal outlook for the 2026-2027 budget year, and the state’s finances are not looking good. The LAO estimates Gavin Newsom and the Legislature will be dealing with an $18 billion shortfall, about $5 billion more than the governor’s administration projected in June, even with revenue exceeding expectations. It also projects the state’s deficit will balloon to $35 billion annually starting during the 2027-2028 budget year.

The office suggested California may need to take more drastic measures than in recent years, as “the state has used most of its budget resiliency tools to address prior deficits.”

One factor contributing to the state’s weak budget situation is a potential AI bubble that the LAO warns could burst. This has been the case with past tech innovations that led to significant investments and stock gains. While the AI market is boosting state income tax revenue, the office sees signs of an “overheated” market that could trigger a boom-and-bust cycle, with “dire” consequences for the state.

Newsom’s Department of Finance will release its own financial projections in January, when the governor presents his initial budget plan. In the past, his administration’s outlook has differed from the LAO’s estimates, and the governor has been critical of gloomy coverage of the nonpartisan analyst’s annual fall outlook that could reflect poorly on him.

AI as a Recruiting Tool for Attracting Next-generation Construction Workers?

The construction industry is at a critical juncture. Persistent labor shortages, an aging workforce, and high turnover rates are forcing general contractors to rethink how they attract and retain talent. To meet demand in 2025 alone, the industry will need to hire an estimated 439,000 additional workers, according to the Associated Builders and Contractors.

At the same time, the digital transformation in construction is gaining momentum as AI reshapes the global economy. A recent McKinsey report found that 92% of companies plan to increase their AI investments over the next three years. Firms that embrace advanced construction AI not only improve project outcomes but also position themselves as desirable employers for the next generation of workers.

Story

—

Weather Machine Politics

Utah is a Republican state, and many of its officials support long-running weather modification programs that help with the state's water supply. Unfortunately for them, the MAHA movement opposes these programs, especially cloud seeding. And the movement has a powerful ally inside the Trump administration: “I’m going to do everything in my power to stop it,” RFK Jr. told meteorologist, psychic, and brain surgeon Dr. Phil in April. NOTUS’ Margaret Manto and reporter Addy Baird from Washington Bureau Initiative partner The Salt Lake Tribune report on how the GOP’s changing politics around science are playing out in Western states.

—

5 Tips for Dealing with Law Enforcement at Work

Every employer should have a law enforcement response plan, experts said recently at the American Bar Association’s annual labor and employment law conference.

More

—

UC Construction Criticism

Politico reported that “A union representing University of California employees is accusing the school system of overspending on construction projects while at the same time laying off its members because of financial pressures. The University Professional and Technical Employees, which counts in its ranks more than 18,000 healthcare workers, researchers and technical support staff, released a report blasting the university for what it described as ‘extravagant spending’ on hospitals and other health care facilities – a claim university officials reject.”

In leveling the allegation, the union pointed to the UC’s ongoing funding for new construction, $20.8 billion in active projects, $31.6 billion in planned projects, and $1.4 billion earmarked for land acquisitions through 2030. The spending, it said, exceeds industry standards and exceeds what was spent on previous projects the university officials identified as similar in scope.

The outlay is particularly troublesome, the union said, given the university’s decision to lay off hundreds of healthcare workers this year, including 230 at UC San Diego Health and 200 at UCSF Health. UC officials have blamed the layoffs on ongoing threats to federal funding stemming largely from the impact of the mega-spending bill Congress passed in June, saying the “federal impacts to health care” and "diminished reimbursements for services” made the staffing cuts necessary.

“We do not have a problem with investing in capital projects,” Dan Russell, president of UPTE, said in an interview. “But when it comes at the expense of investments in frontline staff, investments in patient care, in research and education, that's where we have a problem.” I wonder if Dan would recommend UC eschew PLAs to reduce UC construction costs?

—

Fallout

So far, gubernatorial candidate Xavier Becerra has escaped the bright spotlight focused on Gov. Gavin Newsom in the money pilfering scandal involving their former top aides. But that could change. It seems only a matter of time before one of Becerra’s campaign rivals seizes the federal fraud case for attack fodder. I can hear it already: “If the man who wants to be governor can’t protect his own political funds, he shouldn’t be trusted to safeguard your tax money.” That might not be fair, but this is big-time politics. And the word “fair” isn’t in the political dictionary. Neither Becerra nor Newsom is implicated in any wrongdoing.

Story

—

Contractor Backlog Slips, Strength Depends on Sector

The data spotlights the difference between contractors with work tied to growth sectors and those exposed to softer areas of the construction industry. For example, nearly 65% of contractors think construction activity is contracting, said Anirban Basu, ABC chief economist. That outlook aligns with October’s lowest backlog reading since May. At the same time, 23% of firms expect sales to decline in the next six months, the largest share in more than a year.

Story

—

More 2026 Candidates

Eric Swalwell’s gubernatorial campaign appears imminent and not just because a fundraising page for his campaign was posted on the Democratic platform ActBlue before being taken down Sunday.

Allies have for weeks been circulating polling emphasizing his opening to run as a more moderate alternative to Katie Porter. The Bay Area representative has been making overtures to California labor and other interest groups regarding a run, a key step toward overcoming skepticism in Sacramento fueled by his poor presidential primary performance in 2019 and lack of roots in the state capital. He spent election night not in Washington or his district, but at a local party event in Los Angeles. Alex Padilla’s decision this month not to run for governor opened a path for Swalwell to be the only sitting member of Congress in the race.

There’s also urgency for Swalwell to get in soon. Unlike two other possible entrants, billionaires Rick Caruso and Tom Steyer, he isn’t wealthy and will need to raise money quickly to break through in a crowded field.

Meantime, he’s planning to have at least his second meeting with long-shot Democratic contender Stephen J. Cloobeck, who told Playbook he’d consider backing Swalwell financially and otherwise if he gets in.

“I’m optimistic after meeting all the existing and past candidates that there may be a there, there with Eric. He’s a Fighter and ProtectorTM,” Cloobeck said in a text message. [Politico]

—

AZ Rep. Adelita Grijalva Takes Office, Ending the Second-Longest U.S. House Vacancy of the 119th Congress

On Nov. 12, Speaker of the House Mike Johnson (R-La.) swore Rep. Adelita Grijalva (D-Ariz.) into the U.S. House of Representatives, filling the vacancy in Arizona’s 7th Congressional District. Grijalva’s swearing-in brings the Republicans’ majority in the chamber to 219 to 214 with two vacancies.

The vacancy occurred because Grijalva’s father, Rep. Raúl Grijalva (D-Ariz.), died on March 13. In the Sept. 23 special election to fill the vacancy, Grijalva defeated Daniel Butierez (R) 69% to 29%.

The House was out of session from Sept. 19 to Nov. 12, when they returned and approved the continuing resolution that ended the federal government shutdown. On Oct. 2, 180 House Democrats sent a letter to Johnson asking him to swear in Grijalva during a pro forma session. Johnson said he could not swear in Grijalva during a pro forma session and that he would swear her in when everyone returned.

Not including the special election in Arizona's 7th Congressional District, there have been four other special elections to fill vacancies in the 119th Congress (2025-2027). Johnson swore in three winners—Randy Fine (R-Fla.), Jimmy Patronis (R-Fla.), and James Walkinshaw (D-Va.)—of those special elections the day after their respective elections. Both Fine and Patronis were sworn in during a pro forma session. The other special election, in Texas's 18th Congressional District, advanced to a runoff. As of this writing, Gov. Greg Abbott (R) has not yet announced a date for the runoff. [Morning Brew]

—

How a Book on Workplace Safety Became a Best Seller

- Professor Matthew Hallowell, who founded the University of Colorado Boulder’s Construction Safety Research Alliance in 2018, recently published a book summarizing more than 100 journal papers on workplace safety.

- “Energy-Based Safety: A Scientific Approach to Preventing Serious Injuries and Fatalities (SIF)” summarizes the research in reader-friendly terms. Within 48 hours of announcing pre-order for the book on Amazon, it became a best-seller in its genre.

- The book explores the unique causes of injuries and fatalities: the so-called “Energy Wheel.”

- “Anytime somebody gets hurt, energy from the environment is contacting them,” Hallowell says in an interview.

More

—

Heard This Before

Per the Union-Tribune, “San Diego Supervisors voted 4-1 to back Supervisor Joel Anderson and Paloma Aguirre’s pitch to lead a county subcommittee that will dig into county contracts and how the county could save cash and improve services. The bipartisan duo said their goal is to investigate where the county can save money without disrupting services and potentially change policies that are impeding progress and revenue opportunities for county government.” Here’s my suggestion: reject union PLA proposals for all county projects!

—

Flu Season

A new virus variant and lagging vaccinations could lead to a severe flu season in the US. Health experts are closely monitoring a mutated strain called subclade K, which has caused early surges in the United Kingdom, Canada, and Japan. Flu activity in the US remains low but is rapidly increasing, according to a CDC report. Early analysis indicates that this season's flu vaccines offer some protection against hospitalization from this variant, especially for children. However, data shows many Americans are skipping their flu shots this year. This follows a particularly severe flu season last winter, when the US experienced its highest hospitalization rates in nearly 15 years, and at least 280 children died from influenza, the highest number since 2004.

More

—

California Battery Energy Storage Systems Legislation Update: Safety Requirements and AB 205 “Opt-In” Procedures Amended

In the wake of a catastrophic battery storage facility fire in Moss Landing in January that burned over half the batteries in a 300-megawatt (MW) installation in Monterey County, 2025 has been a rollercoaster year for Battery Energy Storage System (BESS) regulations.

Introduced within days of the Moss Landing fire, Assembly Bill (AB) 303 (Addis) would have immediately banned utility-scale BESS within 3,200 feet of sensitive receptors and removed BESS from eligibility for the California Energy Commission’s (CEC) “Opt-In” permitting procedure under AB 205 (2022) (and required the CEC to deny pending applications).

As the (literal) dust settled, Governor Newsom called for the California Public Utilities Commission (CPUC) to investigate the incident. The CPUC’s investigation, conducted by the Safety and Enforcement Division (SED), as well as several other agencies that investigated water and soil contamination relating to the fire, found no significant impacts. Meanwhile, the CPUC adopted modifications to its General Order (GO) 167 on March 13, 2025, adding new safety standards for BESS.

More

—

Yawn

Feeling bummed about it getting dark so early? Think of the people living in Utqiagvik, Alaska, 330 miles north of the Arctic Circle. Yesterday at 1:36 pm local time, the sun set and it won’t rise again until January 22. For 64 days, residents will experience polar night. Over the entire year, Utqiagvik gets about the same amount of daylight as Miami or any other place on Earth because we all get roughly the same number of hours of sunlight over 365 days. The sun will rise in Utqiagvik in mid-May and won’t set again until August.

—

Happy Thanksgiving!

As we wrap up another busy year in construction, Thanksgiving gives us a moment to pause and appreciate the people who make the electrical and low-voltage industry strong.

To the contractors, journeyworkers, apprentices, electrician trainees, estimators, project managers, and everyone who keeps jobs moving, thank you. Your skill, grit, and commitment build more than structures. You build communities, opportunities, and a better future for the people who live and work in the spaces you create.

This season, we’re grateful for your partnership, trust, and the work you do every day: often early, often late, and often in conditions most people never see.

Wishing you and your families a safe, restful, and well-earned Thanksgiving.

Warm regards,

Rex, Richard and the WECA Government Relations Team