Thursday, February 12, 2026

Republican to Introduce Federal Bill Punishing States with High Gas Taxes

Last time we mentioned a call by California’s Senate Republicans for Gov. Newsom to convene a special legislative session to address high gasoline prices and respond to the impending shutdown of one of the state’s eight remaining gasoline-producing refineries. Recently, Congressman Kevin Kiley announced he is drafting a bill to reduce federal transportation funding for states with gas taxes above 50 cents per gallon. He framed the forthcoming legislation as an effort to punish California, which has the nation’s highest gas tax at nearly 71 cents per gallon. “This bill sends a clear message: states that overtax their citizens to compensate for inefficient spending should not expect unlimited federal support,” Kiley said in a statement. “If Sacramento wants Washington’s help, it should stop punishing drivers.” The bill would also impact Illinois, Washington, Pennsylvania and Indiana, which have gas taxes ranging from 54 to 66 cents per gallon. Kiley, whose congressional district was transformed from a safe Republican to an at-risk district, is looking at fellow Republican Tom McClintock’s seat, a much more Republican district. Kiley was also one of the six Republicans who voted with Democrats to repeal Trump’s tariffs on Canada.

Since Kiley is hinting at a run for Congress in the 5th Congressional District, Rep. Tom McClintock (R-Elk Grove) fired a return volley at his northerly neighbor. He announced he had won the backing of the local GOP committees, which comprise 97% of the population in his district, drawing an early line that a primary challenge from Kiley will be an uphill battle. [Politico]

—

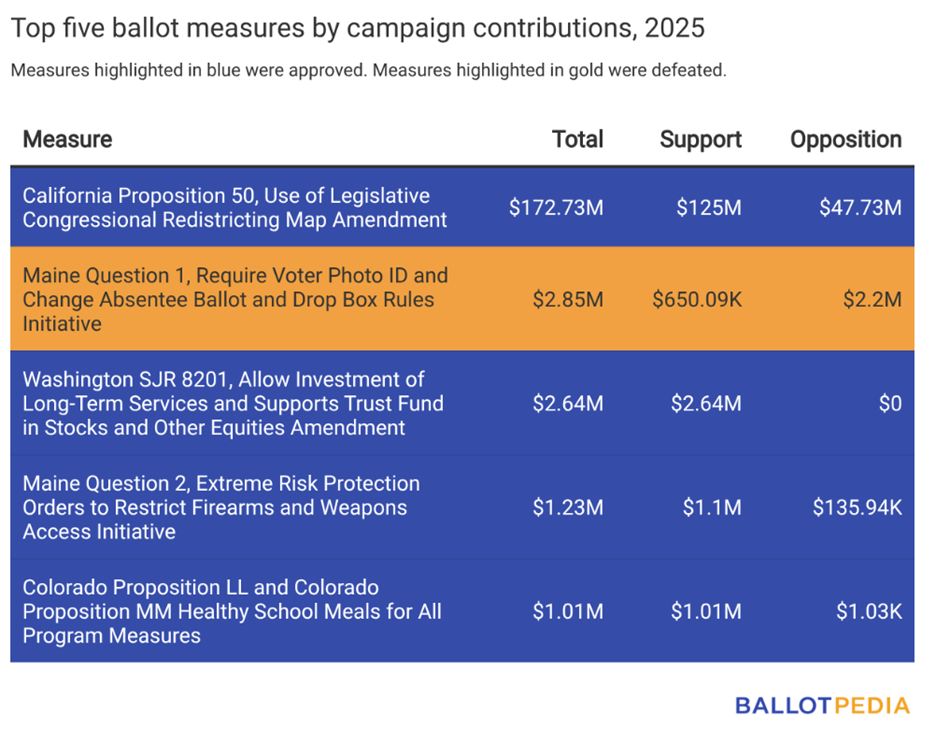

Of the $183 Million Raised Nationwide for 2025 Ballot Measures, 94% Went to California Proposition 50

In 2025, campaigns supporting and opposing 30 statewide ballot measures in nine states raised $183.15 million. Ninety-four percent of that fundraising was either for or against California Proposition 50, which authorized the state to use a new congressional district map.

Here’s a closer look at ballot measure campaign finance from 2025 now that the final reporting deadlines have passed.

Campaigns supporting and opposing Proposition 50 raised $172.7 million, with $124.9 million going to PACs supporting the proposition and $47.7 million to PACs opposing it.

Top donors supporting the ballot measure included the House Majority PAC ($16.5 million) and Fund for Policy Reform ($10 million). The top donors opposing the measure were Charles Munger, Jr. ($36 million) and the Congressional Leadership Fund ($5 million).

Since 2015, California Proposition 50 has been the most expensive ballot measure in an odd-numbered year. The second-most-expensive odd-year ballot measure since 2015 was Maine Question 1 in 2021. In that election, proponents and opponents raised a combined $99.9 million.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

Today, the Congressional Budget Office (CBO) updated its budget and economic projections, which show that the United States remains on an unsustainable fiscal path — and unfortunately the national debt outlook worsened from last year’s projections.

Revenues over the 10-year period are lower than projected for 2025 due to the One Big Beautiful Bill Act (OBBBA). In addition, mounting debt and higher interest rates have pushed up interest costs, which threatens to crowd out other priorities. Finally, longstanding demographic pressures continue to weigh on the fiscal outlook. Taken together, CBO’s report should serve as an urgent warning for lawmakers about the need to address the debt and get the United States on a stronger fiscal path.

You can read the report here.

—

Moderate vs. Progressive Race in Valley Heats Up

California's 22nd Congressional District, near Bakersfield, is one of the handful of districts Democrats hope to pick up during the 2026 midterm elections, where a conservative leaning, mostly Hispanic populace voted for Trump in 2024.

But two Democratic candidates making a bid for the seat highlight the rift among the party over how best to oust the district's GOP incumbent, writes CalMatters' Maya C. Miller.

The labor union SEIU California, several California legislators, and the political action committee Emily's List support Assemblymember Jasmeet Bains. The Bakersfield Democrat and physician is one of the more moderate members of her party in the Legislature and was the only Democrat to vote against the plan to fast-track the special election for Proposition 50.

Meanwhile, leaders of the district's local county Democratic Party, the Working Families Party, and U.S. Sen. Bernie Sanders of Vermont have endorsed Randy Villegas, a political science professor. Though new to politics, Villegas backs progressive policies, including Medicare for All and raising the hourly minimum wage to $25. Story

Smart Wearables: Bridging the Gap Between Workplace Safety and Productivity

- Communication-enabled wearables integrate two-way radio and cellular technology into personal protective equipment to enhance workplace safety through hands-free connectivity.

- These devices utilize bone-conduction technology and noise-canceling microphones to ensure clear communication in loud industrial environments.

- Real-time audio alerts and GPS tracking allow safety managers to monitor worker locations and respond immediately to potential hazards.

- By reducing the need for hand-held devices, these wearables help prevent distractions and accidents during complex tasks.

More

—

More on Lori Chavez-DeRemer

Taxpayers paid nearly $100,000 to resolve an employment discrimination claim that arose from the former congressional office of Labor Secretary Lori Chavez-DeRemer, according to a report from the Office of Congressional Workplace Rights.

The OCWR annual report lists the amount of the award or settlement — $98,650 — and that it was tied to a part of federal statute that bans discrimination based on a worker’s race, color, religion, sex, national origin, disability status or age. The report was uploaded to the office’s website.

It’s the largest award or settlement from a House office since at least 2019, according to past reports, and the secretary’s was the only House office to have an employment discrimination claim payment in 2025.

Awards and settlements that resolve claims under a law are paid from a Treasury Department account that receives appropriations for that purpose, according to a Congressional Research Service report.

The report does not indicate whether Chavez-DeRemer, an Oregon Republican whose one term ended Jan. 3, 2025, was involved in the conduct related to her congressional office.

An internal investigation that sidelined her chief of staff, deputy chief of staff, and a member of her security detail hasn’t tarnished Chavez-DeRemer’s star status in the White House. A month after the New York Post broke the story, Chavez-DeRemer’s standing with the White House remains secure.

"I don’t get the sense from anybody that anybody gives a shit,” a person close to the White House, who requested anonymity to discuss the administration's thinking, told POLITICO. “This has not drawn the ire of anybody, like, 'Oh my god, she’s a problem, we have to deal with her.' I think as long as it stays contained, it’s fine."

Another Republican who regularly interacts with the administration on workforce issues said that the White House “seemed pretty nonchalant about the whole thing.”

Story

—

California’s Retention Reform on Private Construction Projects

Retention has long been a contentious issue in California construction. Traditionally, owners withheld retention of 10% from each progress payment until completion, arguing it was necessary to ensure performance, quality and timely delivery. Contractors and subcontractors, however, often struggled with cash flow, payroll, and material costs while waiting months—sometimes even years—for withheld retention.

Recognizing the financial challenges contractors and subcontractors face, the California legislature passed Senate Bill 61, now codified under California Civil Code Section 8811 and effective January 1, 2026, limiting retention to 5% on private works of improvement, aligning with the public works standard in place since 2012. The law’s intent is clear—ease financial strain on contractors and subcontractors while still providing owners with security (albeit reduced) with respect to project completion. More

—

Ouch, Thanks for Playing in Santa Clara

Seahawks quarterback Sam Darnold is being charged a 'jock tax,' which requires him to pay the State of California more in income taxes for his performance in Super Bowl LX than he earned from the game. Here's a look at the backwards tax approach for the athletes playing in the Golden State-hosted Super Bowl. Story

—

Bonds for Research?

California lawmakers could ask voters in November to pass the largest single-purpose general obligation bond in state history, a proposal to fund research at California universities that would test not only the public’s appetite for borrowing, but the very idea of what kind of expenses a bond should be used to pay for in the first place.

When California has turned to bond measures in the past, it has done so almost exclusively to fund infrastructure. That’s because buildings usually last for decades, making long-term borrowing to pay off the loan with tax revenues a safe bet.

Only twice in recent memory has the state employed bond measures for research, authorizing $3 billion for stem cell research in 2004, after President George W. Bush blocked the use of federal grants for studying human embryonic stem cells, and approving $5.5 billion more for the same purpose in 2020.

The bond lawmakers are pushing at the Capitol now would cost $23 billion.

The bond, like the 2004 measure’s response to Bush, is in direct response to the policies of a Republican president, this time Donald Trump, and his cuts to scientific research funding. Spearheaded by state Sen. Scott Wiener, with the support of the University of California and UAW 4811, a union representing thousands of academic researchers, the bond would provide grants and loans from a state-backed foundation to universities and other research institutions to insulate them from federal funding cuts. The Trump administration has currently suspended $230 million in research funding to the UCs and another $160 million to the Cal State University system, launching several investigations into alleged antisemitism and other civil rights violations on campuses.

“This is really fucking important,” said Lorena Gonzalez, president of the California Labor Federation, at recent event in Sacramento boosting the bond proposal.

Already, nearly a third of the state’s Legislature, including multiple Republicans, have signed onto the proposal, which needs approval from a supermajority to reach Gov. Gavin Newsom’s desk. Many lawmakers were at the event at the Labor Fed’s downtown office space, where attendees helped themselves to wine and a cheeseboard while learning about projects from researchers at the UC, Stanford and USC paused by the Trump administration’s cuts.

To sweeten the appeal, Wiener added a new provision last month that would give the state a cut of licensing fees from inventions developed with bond money.

One potential competing bond would also benefit higher education: a more traditional infrastructure payout for the UC and CSU systems, a priority for both universities after they were excluded from a $10 billion school bond two years ago and have not benefited from a bond measure in 20 years.

Assemblymember David Alvarez, who is carrying that more traditional measure in the statehouse, said that using bonds for non-infrastructure purposes would be “a major conversation” for state leadership. “I'm not saying yes or no, but it's definitely something the governor needs to weigh in on whether he wants to use bonds in this way,” Alvarez said.

But the state had done it once before, when Bush was in the White House. This time, Alvarez said, “We also definitely need to acknowledge the federal threats, right? And so that's very real.” [Politico]

—

Crypto Slumps

The deregulatory Trump bump has now been fully erased. Bitcoin tumbled below $65,000 as the unwinding of leveraged bets and broader market turbulence deepened a selloff that’s wiped out all of the gains since the crypto-friendly Republican returned to the White House.

The token fell as much as 11% Thursday to $64,944, the lowest since October 2024. The rout has erased nearly half of Bitcoin’s value since it reached a record four months ago and has spread to other tokens, related exchange-traded funds and companies like Strategy that hold vast sums of coins.

“The fear and uncertainty across the market is evident,” said Chris Newhouse, head of business development at Ergonia. “Without conviction-based buyers willing to lean into the selling, each wave of ETF redemptions and liquidation cascades.” He said that’s “amplifying the magnitude of each leg lower and reinforcing the defensive positioning that’s keeping organic demand on the sidelines.” [Bloomberg]

|